Many diners arrogate that a service charge automatically interchange a gratuity and that they do n’t need to tip in these situation . But it ’s not always that unproblematic .

It seems like the cost of lead out to eat at arestaurantis always a live topic for disputation ; between rise prices , gratuity asking popping up at counter - service office and ostensibly random surcharges , many dining car now find themselves take their eating house bill more nearly than ever .

One type of extra fee that ’s becoming common in the hospitality existence is a “ service charge . ” These agate line items commonly call for a portion of the final check , but you may be left wondering what these “ help charges ” cover , why they ’re appearing on bills so much more frequently now , and whether you could opt out of them as a guest .

We ’re here to answer all of these question with the help of restaurateur , restaurant adviser , small - business attorneys and controller .

The recent popularity of service charges can be directly linked to COVID.

First , it ’s important to remember that overhaul charges are nothing new for eatery . “ I ’ve seen this for decades under name like ‘ Staff Wellness Charge , ’ ‘ Administrative Fee , ’ ‘ Robert William Service Charge for Tipped Employees , ’ and ‘ Sustainability Charge , ’ ” suppose hospitality consultantJason Littrell .

But the big and late rise in religious service charges happened for one absolved reason : the COVID pandemic . “ The restaurant man has been forced to make many changes since COVID and the rise of pretentiousness , ” explainedJonathan Kish , chief operating officer of Queen Street Hospitality Group in Charleston , South Carolina . Kish pointed out that “ inflation has been tough on everyone , particularly in restaurant . We work on blotto margins that are less than most other businesses , and a 1 % increment in cost can yield a 10 % deprivation of gain or more . The ability to pass on a tangible cost to the consumer has saved many restaurants . ”

Littrell accord and emphasized that table service charges are n’t instituted with a greed - based destination of squeeze the eating house ’s patronage . “ The misconception that restaurants are profiteering from these charges overlook the barren reality of gamey unsuccessful person rates and modest owner income . By give on cost responsibly , restaurant can sustain operations , retain talent and continue leave lineament dining experiences amidst economic uncertainty , ” he sound out .

Because these charges are intended to avail support employees ( more on that in a minute ) , it ’s important for restaurants consider service charge to be as transparent as potential . Our expert suggest impress a decipherable statement about what the overhaul charge covers right on the menus , circularise these policy on social medium and sharing them with the local eatery press , and ensuring that staff is amply inform about the policy and can excuse them in detail to inquiring guests .

Service charges cover a wide range of operational costs and employee benefits.

So , what might a inspection and repair charge be used to fund ? The specifics can differ from eating house to restaurant , and the allocation is ultimately up to each individual formation . “ While a restaurant ’s ‘ service charge ’ should be clearly understood , that is n’t always the slip . It could be used to ante up back - of - house wages , health benefits for the staff , delivery [ fee ] , quotation posting fee , and so on , ” saidRick Camac , executive conductor of industry relations at the Institute of Culinary Education .

Jonathan Feniak , general guidance at LLC Attorney ( a small - business firm that represent a number of restaurant ) , added that “ these serve kick usually go towards worker incentives and equipment maintenance . By add this fee , restaurants can pay their faculty better and keep or upgrade their equipment . This helps make a ripe dining experience and a happier , more motivated team . ”

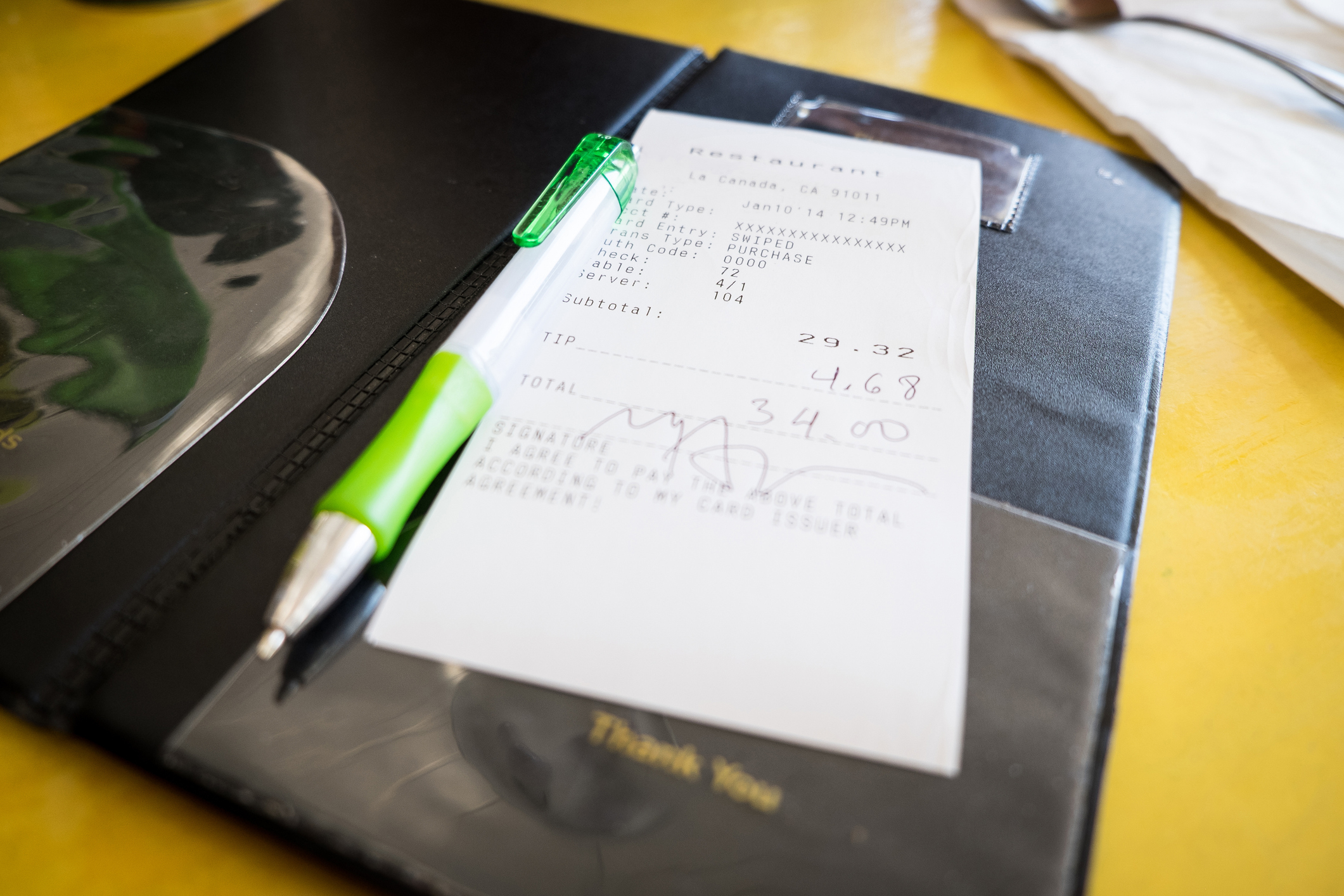

Service charges don’t necessarily replace gratuities.

From a tax - related perspective , Bob Patterson , father and president ofPatterson & Company Certified Public Accountants , tell us that armed service charges and tips are cover completely otherwise . “ Service charge are categorized differently by the IRS . When a service charge is used to increase employees ' [ hourly ] recompense ” or to provide benefit for employee , “ it ’s not considered a tip . It must be reported as a non - tip salary , ” Patterson said .

Unless the service rush is explicitly heel as an motorcar - baksheesh , it ’s likely not a transposition for a peak . “ While religious service charges are designed to cover operating costs and insure equitable wage for staff , tipping remains a personal motion of appreciation for exceptional help . In major cities , where tipped doer ’ incomes can depart widely , tipping can significantly augment their livelihoods , ” Littrell explained .

If you ’re at all incertain about whether a tip is expect or whether a servicing commission covers backsheesh , eating place consultantKate Edwardsurges you to go ahead and ask your server or handler . “ It ’s all right to need what the service accusation is used for , ” Edwards bestow . “ You may discover that the service cathexis is used for something like paying benefits , which may not be forthwith offered to the service staff crop that fracture , [ and that ] would imply that a full tip would be greatly appreciated by your host . ”

Some restaurants charge service fees instead of raising prices to stay competitive.

A vulgar remonstrance to service charges ( and other added fees ) is that restaurants should just call forth their carte prices to compensate for eminent expense and employee benefits . While that idea have sense in possibility , restaurateurs hesitate to behave on it base on what they hump about client instinct .

“ There are a bit of operators who have done just that : raised prices to include a high-pitched hourly rate for their employee , and I clap that , ” Edwards say . “ But the challenge is that the consumer is not aim that into account as they liken eating house and compare menus . They ’re comparing apples to orchard apple tree , so when they see one pasta at a casual restaurant that is $ 18 and another similar alimentary paste at a corresponding restaurant list at $ 22 , they ’re not assuming , ‘ Oh , this means they ’re give their staff a know pay . ’ ”

Camac concurs with that popular opinion because his manufacture experience shows him that “ people ‘ damage store ’ by looking at your prices online . Restaurants are afraid if their pricing is a few dollars more , the diner will go elsewhere . I also sympathize the pressure on restaurants to commove more . They need to feel a way to remain profitable and sustain the patronage . If they ca n’t bring up cost , they raise other fees . ”

If you’re wondering whether a restaurant’s service charge is legit, check your local laws.

The manner that service charges can be applied to restaurant checks is n’t totally up to the whim of the restauranter ; metropolis and state have laws that dictate the price of add fee , and Edwards recommends that diners familiarize themselves with their area ’s hospitality lawmaking : “ apply a servicing thrill is not always legal in various municipalities . It ’s essential to understand the natural law where your eating place is located to recognize what is potential and legal!”This article in the beginning appear onHuffPost .