BuzzFeed , Inc. report Q2 2024 remuneration

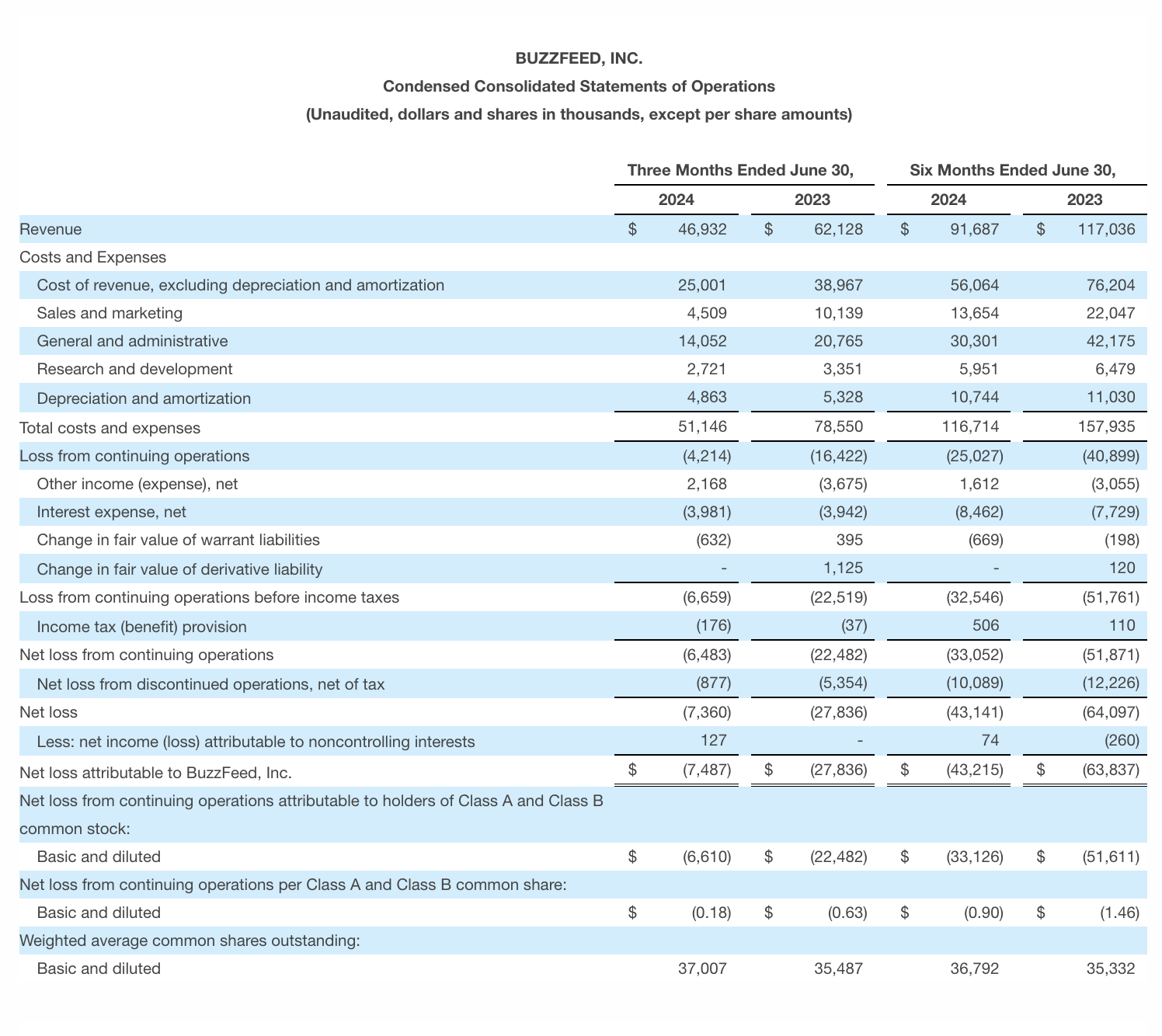

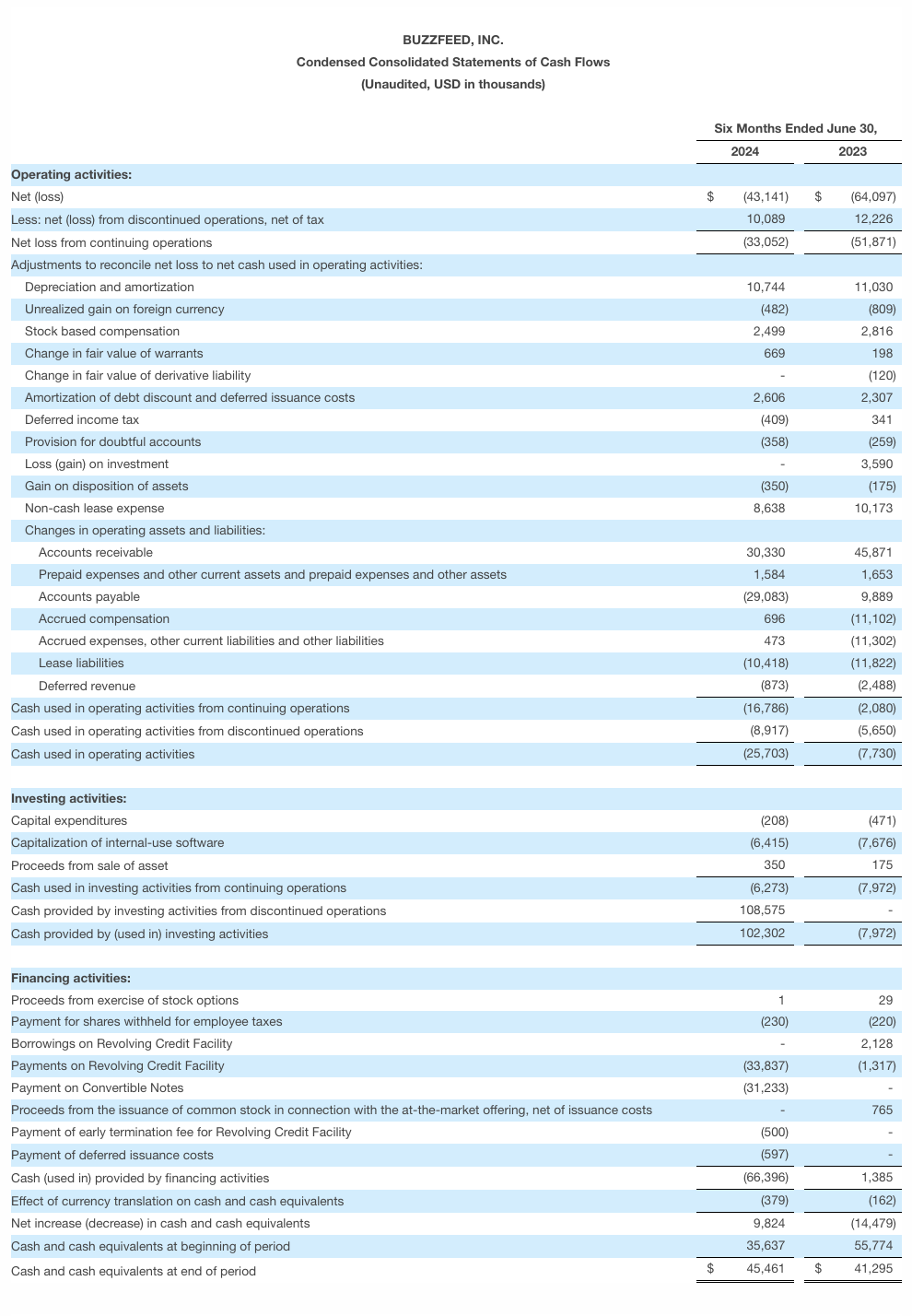

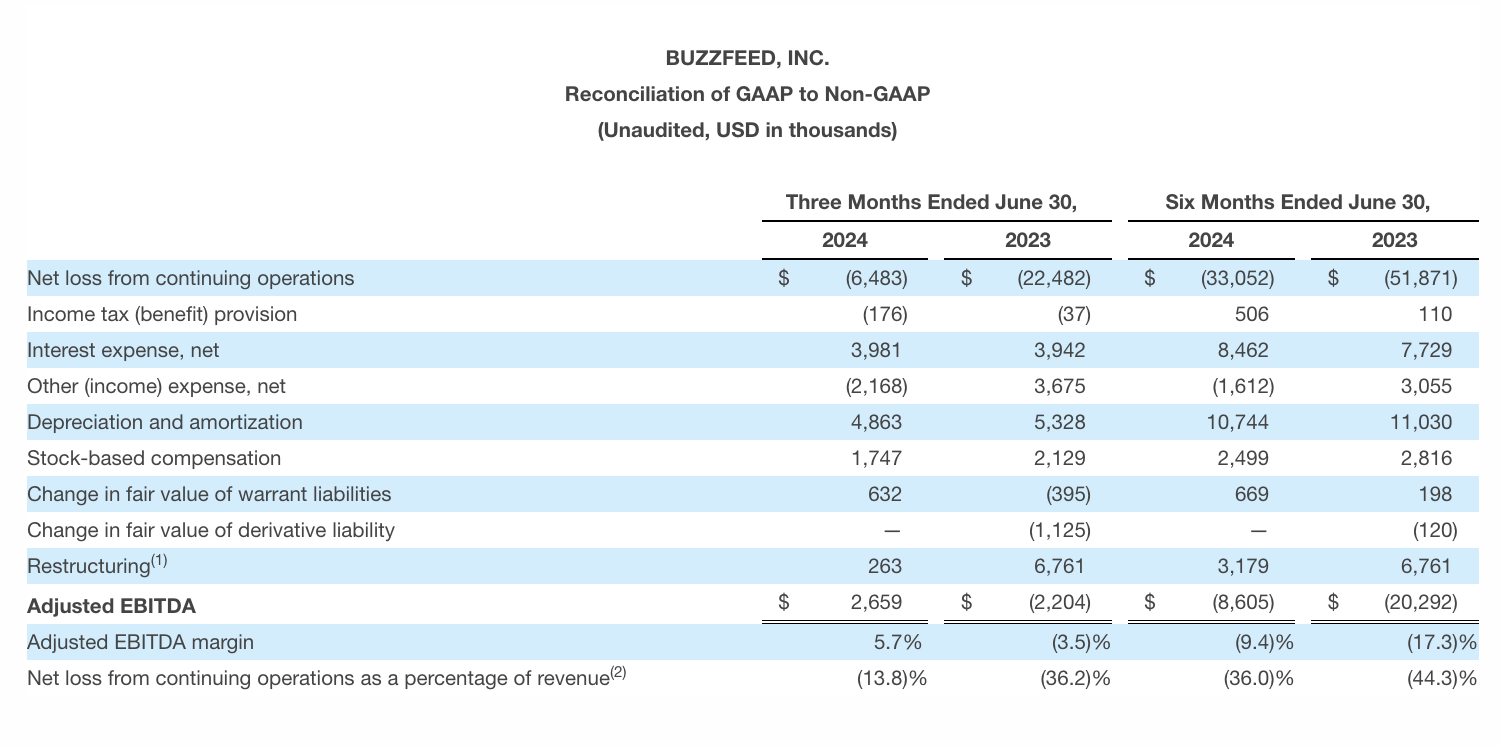

NEW YORK – August 12 , 2024 – BuzzFeed , Inc. ( Nasdaq : BZFD ) report improved 2d quarter ( finish June 30 , 2024 ) last red ink from continuing operation as compare to the anterior - year period , and Adjusted EBITDA ( 2 ) ahead of the Company ’s outlook shared on May 13 , 2024 and retell on July 3 , 2024 . Second quarter revenues were in line with the Company ’s outlook , with year - over - year emergence in two of BuzzFeed , Inc. ’s great and highest - margin revenue stream - Programmatic Advertising and Affiliate Commerce .

“ Our strong performance in Q2 marks a turning stage we ’ve been working toward for the preceding two long time , ” said Jonah Peretti , BuzzFeed Founder & CEO . “ We are beginning to see the benefits of our investment in a differentiated applied science political platform that allows us to accelerate AI product development , make our sites and apps more interactive and personalize , and increase the amount of substance our team and audience can create using AI - powered tools . ”

“ These change are beginning to motor deeper audience engagement and improved revenue trends on our own and operate place , ” Peretti continue . " We are not just focus on making small optimizations to our byplay ; our aspiration is for BuzzFeed to be the defining digital medium companionship for the AI era , and we will execute consequently in the coming age . "

Second Quarter 2024 Financial and Operational Highlights for Continuing Operations(excluding Complex)(3 )

concern and Content Highlights

Third Quarter 2024 Financial Outlook

These statement are forward - looking and actual results may disagree materially as a result of many factors . bear on to “ Forward - Looking Statements ” below for information on factors that could cause our actual results to dissent materially from these frontwards - looking statement .

Please see “ Non - GAAP Financial Measures ” below for a description of how Adjusted EBITDA is calculated . While Adjusted EBITDA is a non - GAAP financial mensuration , we have not provided guidance for the most straightaway like GAAP fiscal measure — net income ( loss ) from continuing operations — due to the underlying trouble in prognostication and quantify certain amounts that are necessary to forecast such a measure . Accordingly , a reconciliation of non - GAAP direction for familiarised EBITDA to the correspond GAAP measure is not available .

Quarterly Conference Call

BuzzFeed ’s direction team will defend a league call to talk over our second quarter 2024 results today , August 12 , at 5PM ET . The call will be available via webcast atinvestors.buzzfeed.comunder the heading News and Events , and party concerned in participating must register in advance at the same localization . Upon registration , all telephone participant will take in a check email detail how to bring together the league call , including the dial - in number along with a unparalleled PIN that can be used to reach the call . While it is not required , it is urge you unite 10 minutes prior to the event start prison term . A replay of the call will be made usable at the same URL .

We have used , and specify to continue to utilise , the Investor Relations segment of our website atinvestors.buzzfeed.comas a mean of discover material nonpublic information and for complying with our disclosure certificate of indebtedness under Regulation FD .

definition

BuzzFeed report tax revenue across three principal business lines : Advertising , Content and Commerce and other . The definition of Time Spent is also determine forth below .

About BuzzFeed , Inc.

BuzzFeed , Inc. is dwelling house to the upright of the Internet . Acrosspop acculturation , amusement , shopping , food and news , our brands force back conversation and inspire what hearing watch , read , and buy now — and into the future . stand on the Internet in 2006 , BuzzFeed is put to making it better : offer trusted , timbre , brand - safe newsworthiness and entertainment to hundreds of 1000000 of people ; making substance on the Internet more inclusive , empathic , and creative ; and inspiring our audience to live serious life .

Non - GAAP Financial Measures

familiarised Earnings Before Interest Taxes Depreciation and Amortization and Adjusted Earnings Before Interest Taxes Depreciation and Amortization margin are non - GAAP financial measures and represent cardinal metrics used by management and our board of directors to assess the operational strength and performance of our business concern , to establish budgets , and to develop operational goals for carry off our commercial enterprise . We determine Adjusted EBITDA as net loss from continuing process , excluding the shock of last income ( loss ) attributable to noncontrolling stake , income tax ( welfare ) provision , involvement disbursal , net , other ( income ) disbursement , net , depreciation and amortization , stock - base recompense , modify in mediocre value of warrant liabilities , vary in fair value of derivative liability , restructuring costs , and other non - cash and non - recurring items that management think are not indicative of ongoing operation . Adjusted EBITDA gross profit margin is calculated by dividing Adjusted EBITDA by gross for the same period .

We consider Adjusted Earnings Before Interest Taxes Depreciation and Amortization and familiarized EBITDA margin are relevant and useful information for investors because they allow investors to view performance in a manner standardised to the method acting used by our management . There are limitation to the use of Adjusted Earnings Before Interest Taxes Depreciation and Amortization and familiarised EBITDA margin and our Adjusted EBITDA and Adjusted EBITDA margin may not be comparable to similarly titled measures of other fellowship . Other companies , including companies in our industry , may reckon non - GAAP fiscal measures differently than we do , limiting the utility of those measures for comparative purposes .

Adjusted Earnings Before Interest Taxes Depreciation and Amortization and Adjusted EBITDA margin should not be considered a substitute for measures prepare in conformity with GAAP . Reconciliations of non - GAAP financial measures to the most directly comparable financial final result as determined in accordance with generally accepted accounting principles are include at the end of this press release following the follow fiscal data .

Forward - Looking Statements

Certain argument in this insistency tone ending may be considered forward - looking statement within the meaning of subdivision 27A of the Securities Act of 1933 , as ameliorate , and Section 21E of the Securities Exchange Act of 1934 , as amended , which affirmation necessitate substantial risk and uncertainties . Our forward - looking statement admit , but are not limited to , statements regarding our management squad ’s expectations , hopes , feeling , aim or strategy regarding the time to come . In summation , any statements that refer to protrusion , forecasts ( include our outlook for Q3 2024 ) or other characterizations of next events or condition , including any underlie assumptions , are frontward - look statements . The word “ dissemble , ” “ look for , ” “ think , ” “ can , ” “ contemplate , ” “ extend , ” “ could , ” “ forecast , ” “ expect , ” “ forecast , ” “ signify , ” “ may , ” “ might , ” “ program , ” “ possible , ” “ potential , ” “ predict , ” “ task , ” “ seek , ” “ should , ” “ target , ” “ will , ” “ would ” and similar reflexion may distinguish forward - looking argument , but the absence seizure of these word does not intend that a instruction is not forward - looking . Forward - seem statement include all matters that are not historical fact . The forrard - front statements contained in this insistence release are found on current expectations and beliefs touch future developments and their likely effects on us . There can be no assurance that future exploitation affecting us will be those that we have promise . These forward - take care statements call for a number of risks , ( some of which are beyond our mastery ) uncertainty or other assumption that may cause actual results or execution to be materially different from those expressed or implied by these forward - looking assertion . These risk and uncertainties let in , but are not limited to : ( 1 ) developments touch to our competitors and the digital medium manufacture , include overall requirement of advertising in the mart in which we operate ; ( 2 ) demand for our product and service or change in traffic or engagement with our brands and depicted object ; ( 3 ) changes in the business and competitive surroundings in which we and our current and prospective partners and advertiser operate ; ( 4 ) macroeconomic factors including : inauspicious economical status in the United States and globally , including the possible onset of recess ; current worldwide supply range of mountains disruptions ; likely governing closedown or a failure to fire the U.S. Union debt cap or to fund the federal government ; the ongoing conflicts between Russia and Ukraine and between Israel and Hamas and any related authorisation and geopolitical tensions , and further escalation of swop tensions between the United States and China ; the inflationary surroundings ; high unemployment ; eminent interest rates , currency fluctuation ; and the private-enterprise working class mart ; ( 5 ) our next capital demand , include , but not limited to , our ability to obtain extra majuscule in the futurity , to conciliate conversions of our unlatched convertible musical note , buy back the government note upon a profound change such as the delisting of our Class A vulgar store or repay the notes in John Cash at their matureness any restrictions bring down by , or commitments under , the indenture govern our unguaranteed notes or agreements governing any succeeding indebtedness , and any restrictions on our ability to get at our cash and cash eq ; ( 6 ) developments in the jurisprudence and government regulation , including , but not restrain to , revised foreign subject and ownership regulations , and the result of legal proceeding , regulative contravention or governmental investigation to which we are subject ; ( 7 ) the benefits of our price savings beat ; ( 8) our success divest of ship’s company , assets or firebrand we sell or in integrate and supporting the companies we larn ; ( 9 ) technological ontogeny including artificial intelligence ; ( 10 ) the impact of activist shareowner activity , include on our strategical direction ; ( 11 ) our achiever in retain or recruiting , or changes required in , officer , other key employees or directors ; ( 12 ) use of content creators and on - television camera talent and human relationship with third parties managing certain of our branded operations outside of the United States ; ( 13 ) the security of our information technology systems or datum ; ( 14 ) dislocation in our inspection and repair , or by our bankruptcy to timely and effectively scale and adapt our existing applied science and substructure ; ( 15 ) our ability to maintain the listing of our Class A common stock and stock warrant on The Nasdaq Stock Market LLC ; and ( 16 ) those agent depict under the section entitled “ Risk Factors ” in the caller ’s annual and quarterly filings with the Securities and Exchange Commission .

Should one or more of these jeopardy or uncertainties materialize , or should any of our assumptions prove wrong , actual result may vary in material deference from those projected in these forward - looking statements . There may be additional endangerment that we view immaterial or which are nameless . It is not possible to foretell or identify all such risk . We do not attempt any obligation to update or revise any forwards - seem statements , whether as a consequence of new information , next case or otherwise , except as may be require under applicable securities police force .

( 1 ) Source : Comscore Media Trend , desktop 2 + and peregrine 18 + , background and mobile ; June 2024 ; [ competitory Set : Dotdash Meredith , Conde Nast Digital , Vox Media , masses , Bustle Digital Group , Vice Media Group , Hearst ]

( 2 ) As used throughout , familiarised Earnings Before Interest Taxes Depreciation and Amortization is a non - GAAP fiscal amount . Please refer to “ Non - generally accepted accounting principles Financial Measures ” below for a description of how it is calculated and the tabular array at the back of this earnings release for a reconciliation of our generally accepted accounting principles and non - GAAP final result .

( 3 ) The Company fix the assets of Complex Networks , excluding the First We Feast stigma , met the classification for “ agree for sale . ” Additionally , the Company concluded the disposition , which hap on February 21 , 2024 , represent a strategical shift that had a major effect on our operation and fiscal results . As such , the diachronic financial results of Complex Networks have been reflected as discontinued trading operations in our condensed coalesced financial statements . Amounts presented throughout this press passing are on a continuing mathematical process basis ( i.e. , chuck out Complex Networks ) .

( 4 ) BuzzFeed , Inc. is herein referred to as “ BuzzFeed ” or the “ companionship . ”

( 5 ) Includes Complex Networks and First We Feast ; see definition of “ Time Spent ” below .

( 6 ) +11 % yr - over year , grant to Adobe Analytics , as report byCNBC .

#

Contacts

Media Contact

Juliana Clifton , BuzzFeed:juliana.clifton@buzzfeed.com

Investor Relations Contact

Amita Tomkoria , BuzzFeed:investors@buzzfeed.com

( 1 ) We turf out restructuring expenses from our non - generally accepted accounting principles measures because we conceive they do not reflect expected next operating expense , they are not indicative of our nucleus operating performance , and they are not meaningful in comparison to our past operating performance .

( 2 ) Net personnel casualty from proceed surgical process as a percentage of tax income is admit as the most like GAAP measure to Adjusted EBITDA allowance , which is a Non - generally accepted accounting principles measure .